Liability for a business is something that a business owes; these liabilities are mostly in the form of a certain amount. Liability is also a business debt because you have to pay the amount you owe in a given time, either short-term or long-term. It is crucial for a business to know its liabilities and when and where to record them in the financial documents.

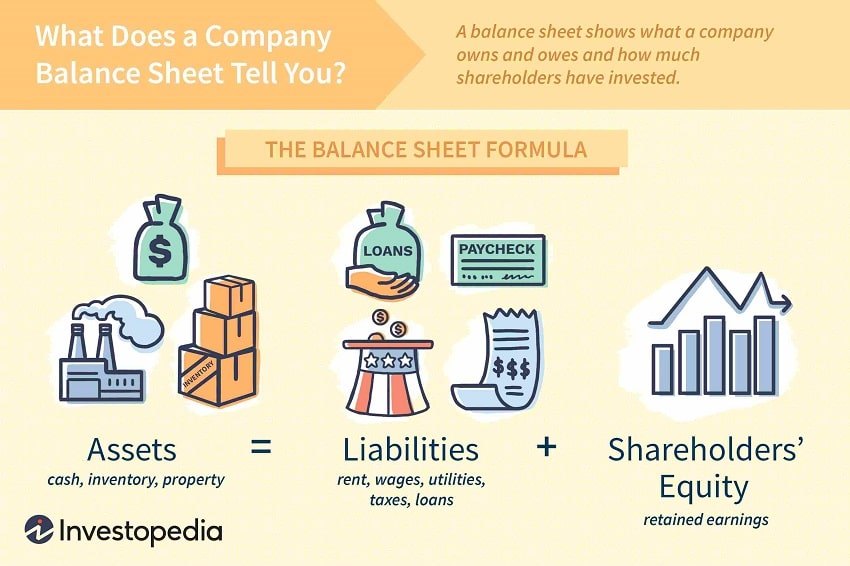

The most important business records where liability is a must to record in the balance sheet. The balance sheet determines any business’s financial position and growth while including assets and liabilities with the owner’s equity at one side. With the help of these values in the balance sheet, you can determine the total assets of a business while adding the liabilities and the owner’s equity. In contrast, you have to subtract the liabilities from the assets to find the owner’s equity. Some of the liabilities a business has are as follows.

- Bank loans

- Unpaid bills

- Mortgages

- Payroll taxes

- Salaries and wages payable

Keep reading this blog to get familiar with the different types of liabilities necessary to include in the balance sheet.

Top Three Types of Liabilities to Record in the Balance Sheet

A business needs to know its financial value and position; this can only be achieved when you know the total earnings and the amount due that is yet to pay to others. You need to have an updated and accurate balance sheet for that purpose, which is incomplete without the business liabilities. Based on the time you are obliged to pay, these liabilities are divided into various types and categories. Below is the list that is enlisted in a business balance sheet.

1) Current liabilities

Current liabilities are also known as short-term liabilities. They are one of the most important types of liabilities mentioned in the balance sheet. These are the debts that a business has to pay within the next 12 months. For keeping track of time, these are important to be recorded in the sheets, as they are to pay within 12 months of recording in the balance sheet.

Many businesses approach the bookkeeping and accounting firms in Dubai for accurate recording of liabilities while balancing the assets with the liabilities and owner’s equity for a balanced sheet.

Below are some types of current liability.

a. Accounts payable

Accounts payables are the amounts that a business has to pay for the services they have availed from any other business or organization. You need to be aware of the due dates of these payables so that you do not have to pay any penalties and fines. The accounts team will help businesses keep these exact payable amounts and ensure they are paid within the timeframe.

b. Unearned revenue

Unearned revenues are the amount received by a business from its customers for which the services and products are not provided yet. These are listed as the liabilities in the balance sheet as long as the services are not provided. When the services are provided to the customers, then these amounts are enlisted in the assets portion of the balance sheet. Ensure you are removing the amount from the liability section when you deliver the services; otherwise, your sheet will not be balanced.

c. Mortage payable

Mortage payable is the amount due after the purchase of a property; this liability can be short-term or long-term, depending upon the conditions. The amount due to be paid in the next 13 months will be recorded as a short-term liability. On the other hand, the remaining outstanding amount will be recorded as a long-term liability in the balance sheet.

2) Non-current liability

Non-current liabilities are the debts a business has to pay in the long term; You do not have to make the payments in 12 months. Below is the list of long-term liabilities that are a must to enlist in the balance sheet of a business.

- Bonds payable

- Notes payable

- Deferred liability

- Capital leases

3) Contingent liability

Contingent liabilities are not declared as a business liability as of now. The chance of them becoming a liability in the future becomes higher the business list them as liabilities. Remember these are contingent not declared liabilities. So, you need to be careful while adding them to the sheets. You can hire accounting firms in Dubai to ensure the safe and accurate recording of various data with their differences clearly mentioned on the sheets.

Final words!

For a business to know its position well, its sheets and records must be balanced and updated. For a sheet to be balanced, enlisting every important element is crucial; one of the important elements is a liability. Make sure you know the different types of liabilities and when and where to record them. Or you can ask for expert help to do the job for you.

Learn more:

Monthly Bookkeeping Checklist Every Business Should Follow

Some of the Essential Financial Skills to Learn in 2021